-

UAE’s Economic Surge: What It Means for Current and Future Businesses

- 13.09.2024

- Posted by: Uwe Hohmann

- Categories: Company Setup, Dubai

No CommentsThe UAE’s economic growth in 2024, particularly in non-oil sectors like finance, tourism, logistics, and construction, presents significant expansion opportunities for both established businesses and prospective European companies looking to enter the market.

-

UAE Corporate Income Tax: Essential Information for New Businesses

- 06.09.2024

- Posted by: Malavika Kolera

- Categories: Tax, Dubai

Newly established businesses in the UAE must register for corporate income tax within a mandatory 3-month window to avoid penalties.

-

UAE Visa Amnesty: What It Means for Businesses in Dubai

- 06.09.2024

- Posted by: Uwe Hohmann

- Categories: Dubai, Middle East

The UAE’s two-month visa amnesty program offers businesses the chance to regularize employee visa statuses without penalties, ensuring compliance and operational continuity.

-

Dubai: The Rising Star for Women in Business

- 06.09.2024

- Posted by: Uwe Hohmann

- Categories: Dubai, Middle East

Discover why Dubai is fast becoming the ultimate hub for ambitious women entrepreneurs, offering unique advantages that rival even the top global business centers.

-

The UAE’s Growing Non-Oil Trade is a Business Opportunity

- 30.08.2024

- Posted by: Malavika Kolera

- Categories: Tax, Dubai

The UAE’s non-oil trade surged to EUR 350 billion in early 2024, creating avenues for EU businesses to enter the Middle Eastern market, especially through favorable CEPA agreements.

-

What the EU-GCC Summit Means for European Businesses

- 30.08.2024

- Posted by: Uwe Hohmann

- Categories: Dubai, Middle East

The EU-GCC Summit presents an opportunity for European businesses to capitalize on enhanced trade agreements and partnerships in the rapidly growing markets of the Gulf region, particularly in the UAE.

-

Dubai Becomes the Best Destination for Digital Nomads and Entrepreneurs

- 30.08.2024

- Posted by: Uwe Hohmann

- Categories: Dubai, Middle East

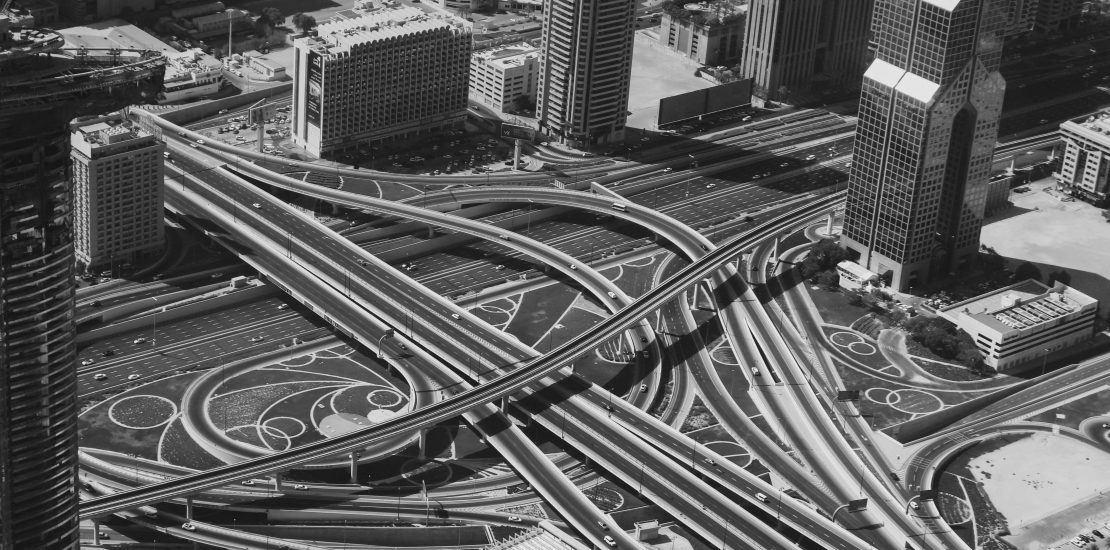

Dubai is attracting more professionals and small businesses with its convenient location, modern amenities, and tax benefits, making it an appealing place to live and work.

-

Saudi Arabia’s Economic Diversification: Businesses Opportunities

- 24.08.2024

- Posted by: Uwe Hohmann

- Category: Middle East

Saudi Arabia’s 7.3% rise in non-oil exports highlights a growing market that’s ripe for businesses looking to tap into the Middle East, with the Kingdom’s push for economic diversification under Vision 2030 offering new opportunities, especially in the chemical and manufacturing sectors.

-

Dubai vs Germany: A Business Perspective in Uncertain Economic Times

- 24.08.2024

- Posted by: Uwe Hohmann

- Categories: Dubai, Middle East

As Germany faces economic downturns and manufacturing challenges, Dubai emerges as a resilient, growth-oriented alternative, offering tax advantages, streamlined business processes, and a diverse economy – making it an attractive destination for businesses and individuals considering relocation during these uncertain times.

-

Dubai Freelancers and Small Businesses: What You Need to Know About Corporate Income Tax

- 24.08.2024

- Posted by: Malavika Kolera

- Categories: Tax, Dubai

Discover how Dubai’s corporate income tax rules could offer unexpected relief and flexibility for freelancers and small businesses, with extended deadlines and exemptions that could change the way you plan your business finances.